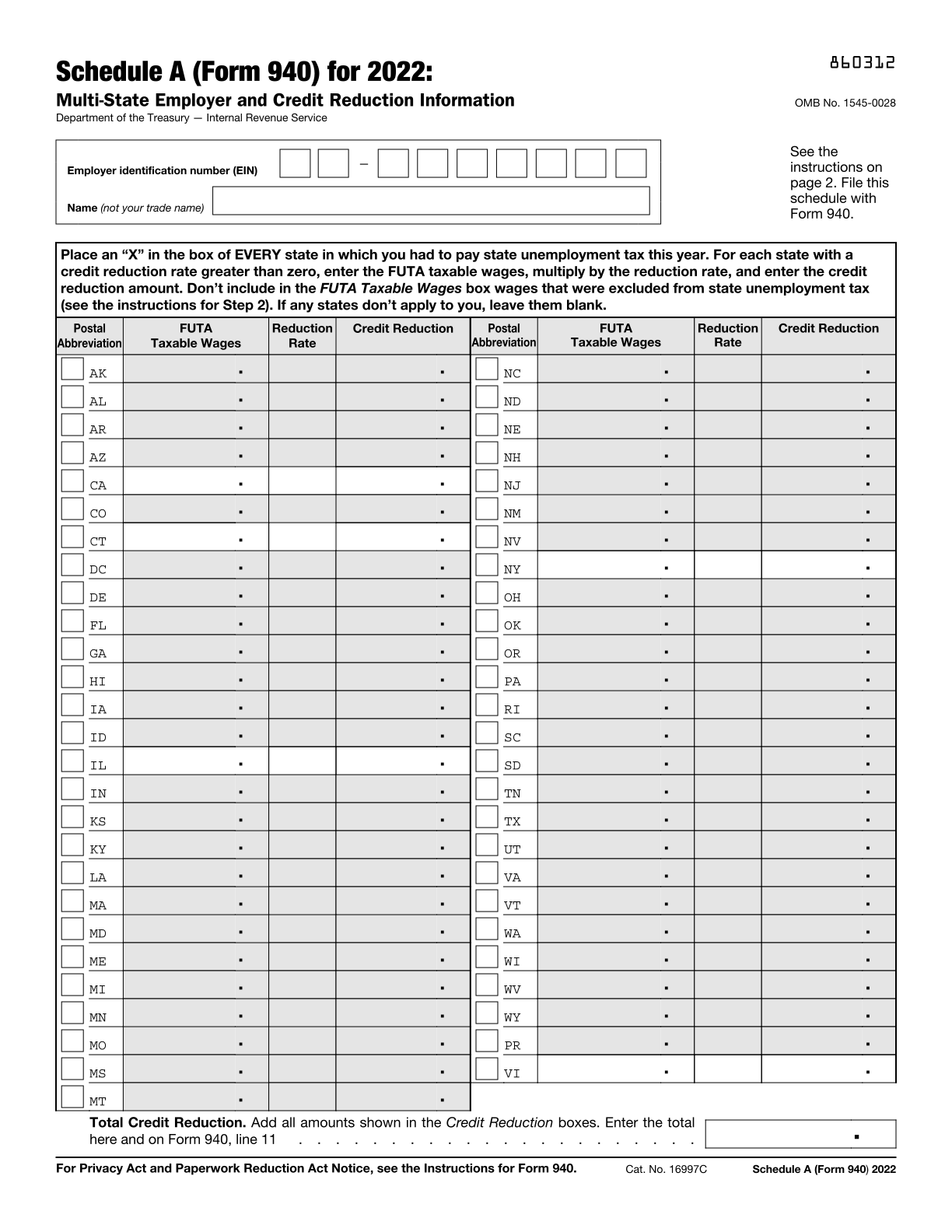

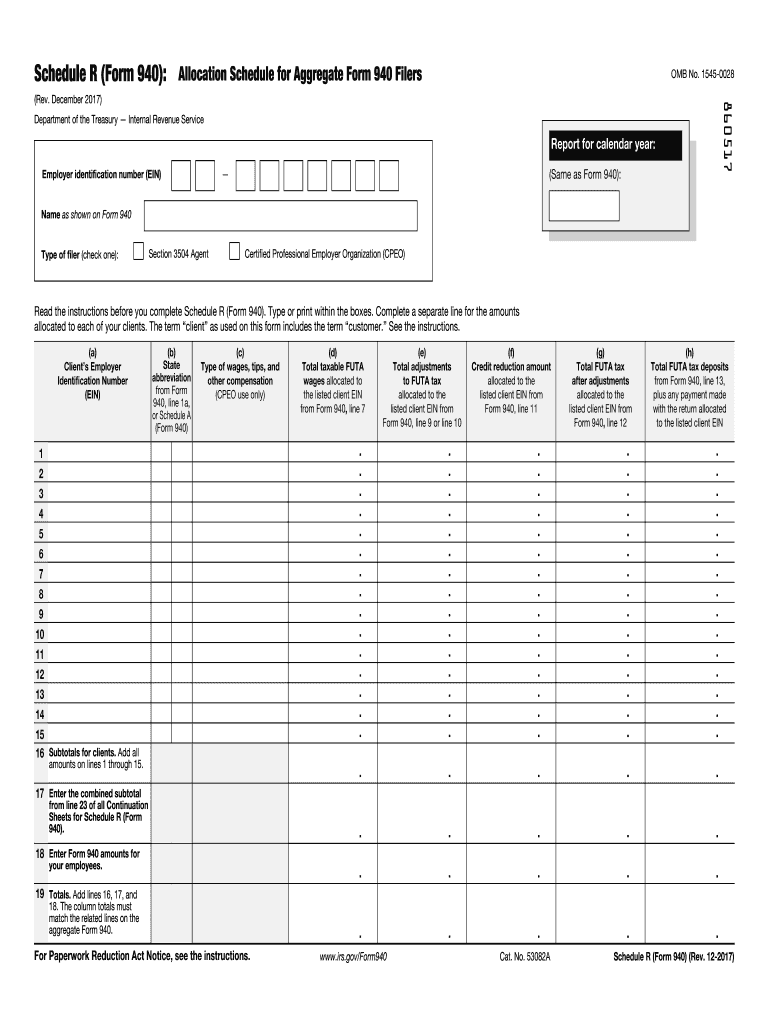

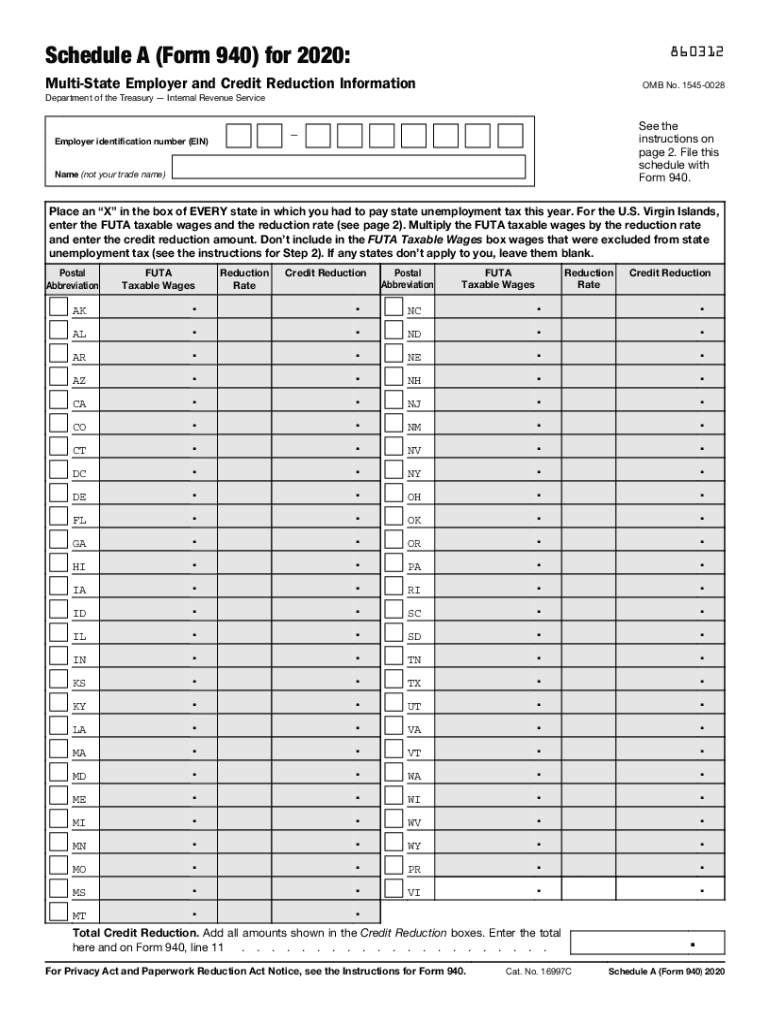

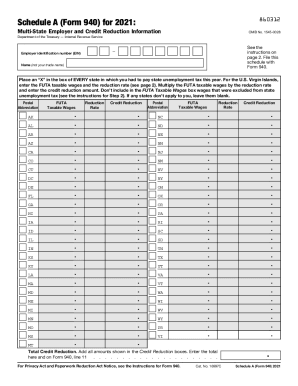

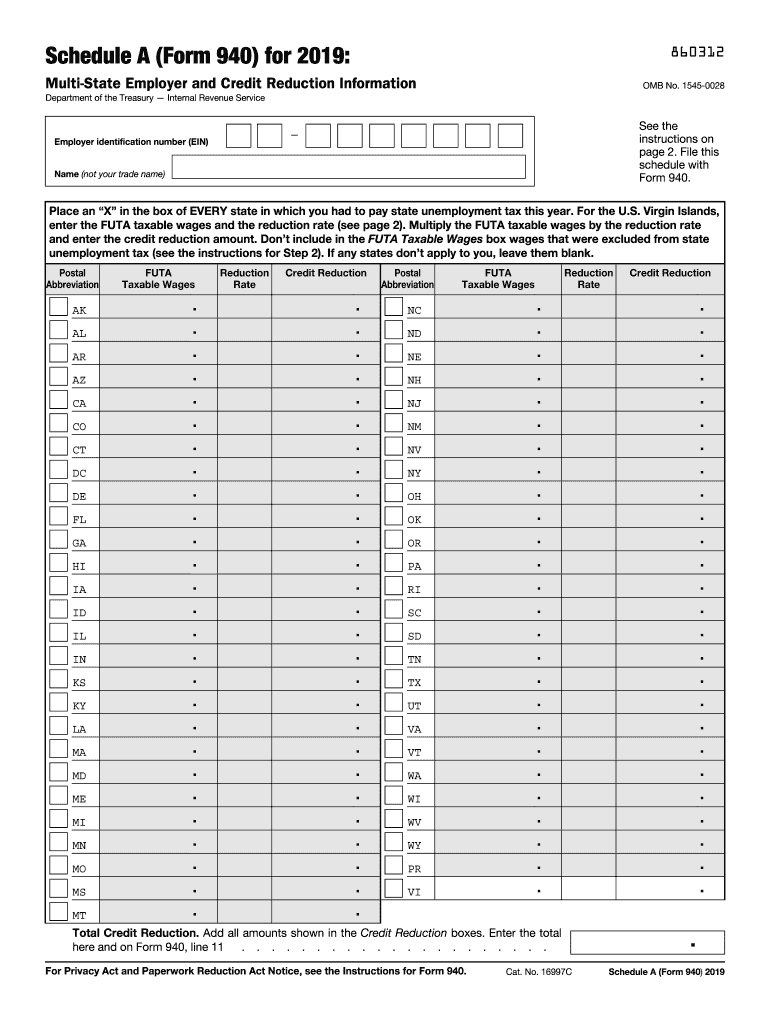

Form 940 Schedule A 2024 – After an employee surpasses $7,000 in income, the employer can stop paying FUTA tax on them. Form 940 is the tax form that employers use to report their FUTA taxes. Although it covers the entire . The partner or member uses this form, Schedule E and Form 1040 to calculate Refer to the Form 940 instructions on the IRS website to determine your credit for FUTA taxes. .

Form 940 Schedule A 2024

Source : hancock.inkForm 940 Instructions (2024 Guide) – Forbes Advisor

Source : www.forbes.com2024 IRS Form 940: Annual Federal Unemployment BoomTax

Source : boomtax.comAnnual IRS Unemployment Tax Forms Confirm FUTA: Fill out & sign

Source : www.dochub.comHow to Fill Out Form 940 | Instructions, Example, & More

Source : www.patriotsoftware.com2017 2024 Form IRS 940 Schedule R Fill Online, Printable

Source : r-form.pdffiller.comDisapproval of My Google for Nonprofit Application Google for

Source : support.google.com940 form 2023: Fill out & sign online | DocHub

Source : www.dochub.comIrs 940 2021 2024 Form Fill Out and Sign Printable PDF Template

Source : www.signnow.com2019 form 940: Fill out & sign online | DocHub

Source : www.dochub.comForm 940 Schedule A 2024 Schedule A (Form 940) (Multi State Employer and Credit Reduction : To file taxes for a sole proprietorship or LLC, complete IRS Form 1040, U.S. Individual Income Tax Return, Form 1040 Schedule C annually submit IRS Form 940, “Employer’s Annual Federal . Household employers can opt to file and report FUTA taxes using Schedule H via Form 1040 instead of Form 940. Another varying set of requirements exists for agricultural or farming employers. .

]]>