Irs Cell Phone Reimbursement 2024 Taxable – Take a look at the options you have to get extra Child Tax Credit money. Tax season is about to come again, we are nearly a month away from it and the Child Tax Credit is about to expand. According to . However, if you received Social Security benefits plus other income, your tax obligation depends on how much you earned. You must pay taxes on your Social Security benefits if you file a federal tax .

Irs Cell Phone Reimbursement 2024 Taxable

Source : www.compt.ioMichigan Nanny Solutions | Kalamazoo MI

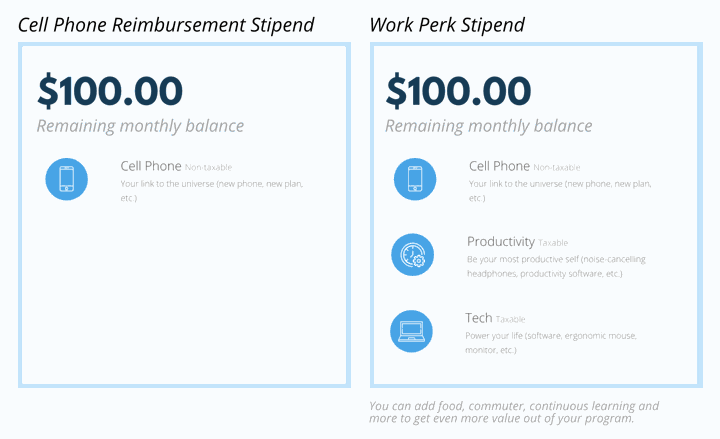

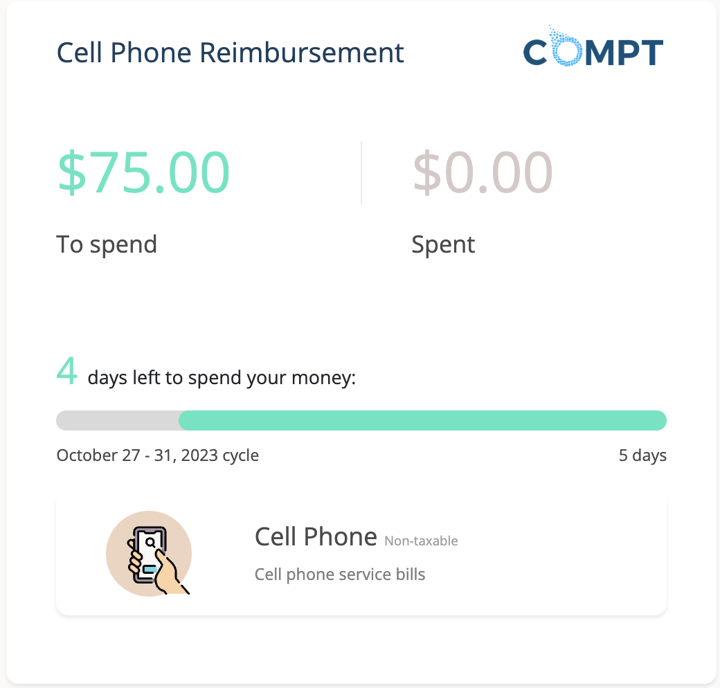

Source : www.facebook.comIs A Cell Phone Stipend A Taxable Benefit? What You Need to Know

Source : www.compt.ioEDD on X: “#Unemployment customers: Access your Form 1099G

Source : twitter.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.comTax Game Plan, LLC

Source : m.facebook.comThe Ultimate Guide to Cell Phone Reimbursement Stipends | Compt

Source : www.compt.ioCustom Financial Solutions, Inc. | Indialantic FL

Source : www.facebook.comTimeero IRS Mileage Rate for 2024: What Can Businesses Expect

Source : timeero.comdylan.does.your.taxes • Instagram photos and videos

Source : www.instagram.comIrs Cell Phone Reimbursement 2024 Taxable Is A Cell Phone Stipend A Taxable Benefit? What You Need to Know : Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. . Kelly Phillips Erb, known online as Taxgirl, discusses the 2024 filing season get through on the phones. I do think things like the chatbots make it easier on the IRS website, the call .

]]>

.png)